Common knowledge among junior mining investors:

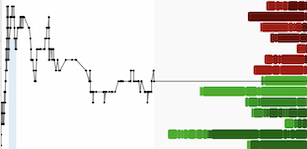

- The sector is cyclical with strong ups and downs

- To make money you need to accept that the stock will retrace 50% or more regularly before it truly breaks out

So why do people keep saying you need to HODL a good stock? The only time it sort of makes sense to HODL is if you got in at the beginning and have a full position. But even then, considering the common wisdom among investors in this sector, why would you do that? Why wouldn't you take profit, sit on the cash and add on the next dip which is bound to come anyway?

Junior miner stock prices are very volatile, so why would you HODL your position and watch it go up 120% just to watch it slide until you're down 50%? These companies don't pay dividends so the only reason I can think for HODL'ing a large position without ever selling shares is FOMO. I.e.: "What if this one is the breakout to the moon?"

But how often does that really happen? Every single time I added to a position when the stock had a confirmed technical breakout, it slid right back down under the breakout price within a few months. So how meaningful are these breakouts really in this sector?

Sure you can't perfectly time the tops nor the bottoms, unless you're extremely lucky because this is not a skill that can be trained. So why not take some profit along the way? I've only been investing in this sector for a little over 3 years but I am sure I have lost more money by HOLD'ing a stock than I've lost on selling early, worse still by selling early and then FOMO'ing my ass right back in at a higher price just to watch the price drop again which made me want to HODL to recover my losses.

FOMO and HODL are not investment strategies.

FOMO leads to HODL, HODL leads to bagholding, bagholding leads to loss, loss leads to the dark side.

This is the way