Like many on this site I started my junior investing journey buying shares in a strongly promoted but poorly performing company. When I exited this company, I wasn't fully convinced, in fact I really didn't want to sell.

But my wife and I were investing in company together. The company was our largest position and most of the money we had in it was actually hers. I wanted to believe the story told by the bulls here, I liked all the potential. My wife didn't care for the story and barely looked at it, instead she looked at technicals and felt her money could be better used elsewhere.

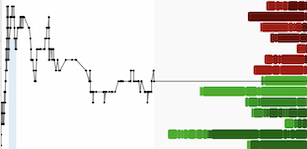

So in December 2020 we sold our shares at a loss. I was still convinced that the new mine would be a huge catalyst, but it was her money. Only when we exited and I no longer had skin in the game, did I start to see things for what they are. None of the promises that had been made in the past 6 months had come to pass. I had been told that one thing after the other would be a catalyst and for a time this looked to be true as the stock rose to CAD 4 in July. September would reach CAD 6, The big insider would exercise its warrants. Until then we had made some money trading in and out, but by September the tide was already starting to turn.

- The purchase of the mill and mine wasn't the big catalyst it was promised to be

- No more financing would be needed because the mine and mill would fund everything but within 2 months of the first gold bar rolling out of the mill, a new financing was announced at sub market price values.

- The big insider didn't exercise its warrants because the stock didn't reach CAD 6, instead by end November they sold 2/3 of their shares

- The game changing new technology was bought, arrived and not used for 9 months.

- The first gold bar rolled of the mill and the market was happy for a very brief period but again it didn't turn into the big catalyst everyone was saying it would be. My wife even bought back in and lost some money on it even though I already had my doubts at this time.

- I was told management had skin in the game but when I checked SEDI that skin was cheaply bought and can still be easily shed without leaving more than a superficial scratch (actually most of them are still in the green at these prices) while they rake in 6 figure salaries.

- I was told the company was the CEOs's baby yet he appeared to spend more time on his 20 other jobs and was in fact applying for a new full time position elsewhere

- I was told the CEO put himself in debt to get the company started but refused to see that that was 10 years ago and the company had paid him back many times over in one way or another

None of these things I was willing to see while I held shares, I wanted the bull's story to be true because then my investment would mean something. But the stock doesn't know or care that you own it.

When we sold our shares I took a step back. I learned to read the difference between what management says and what management does. I learned that what the bulls on these boards say, tends to be at best overly optimistic and at worst entirely self-serving, and that the only way to be sure is by listening to both side with an open mind and check the data yourself, see for yourself to which side they actually match closest.

I gave everyone here the benefit of the doubt when I first encountered them, there are a few here from whom I truly learned how to become a better investor and how to do my own DD and there are several here from whom I learned that while they might ride their high horse, their words in fact ring hollow as the data doesn't support their claims when held up to the light.