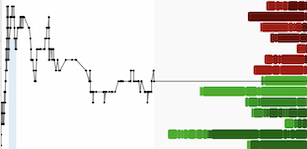

The copper market is on fire! Prices have been surging in recent months, bumped up in January, from $3.74 per pound on January 4 to $4.25 on January 20, driven by a combination of strong demand and tight supply.

A recent Goldman Sachs commodities forecast suggests that copper will average around $4.42 per pound in 2023. Those numbers could reach as high as $5.54 next year. They cite supply woes, declining capital expenditures and mine disruptions for rising metal prices.

One of the main drivers of this surge in copper prices is the growing demand for the metal in the construction industry. Copper is widely used in building wire, plumbing, and other applications, and as the global economy continues to recover from the pandemic, more and more buildings are being constructed.

Another factor driving copper prices higher is the increasing use of the metal in electric vehicles (EVs). Copper is a vital component in EV batteries and charging infrastructure, and as more and more people switch to EVs, the demand for copper is expected to continue to rise.

But it's not just the demand for copper that's pushing prices higher. Supply is also tight, as mines around the world have been hit by production disruptions due to the pandemic. Additionally, many copper mines are nearing the end of their lives, and new mines are not coming online as quickly as needed to meet growing demand.

So what does this all mean for consumers? If you're in the market for copper-based products, expect to pay more. And if you're an investor, the copper market looks like a great opportunity for growth. Just make sure to do your own research and invest wisely.

In short, the copper market is on the rise, fueled by strong demand and tight supply. Prices are expected to continue to climb in the coming months and years, making it an attractive option for investors. It's a trend to watch!