After finding Beacon Minerals, which is a Western Australian gold miner (BCN.ax ASX), I pondered whether it was the best gold miner value stock there is. The numbers are spectacular. Allen EV/EBITDA is 2.26, OE (Owners Earnings) is a 37% yield on market cap, and it has over 15% of market cap as cash (>$14 million cash) and no real debt, just equipment leases. They are in one of the safest areas in the world to mine; in fact, it is sometimes rated as the #1 jurisdiction. It even has a big dividend.

Here are the numbers from UncleStock on Beacon.

I am not alone in seeing their value as amazing. Argonaut has a 9-page article on it that is highly positive for Beacon. https://secure.argonaut.com/FileLink.asp?DT=R&DID=11155&DP=6713 Here is their summary of Beacon.

Quick Read

Beacon Minerals (ASX:BCN) is a small WA-based gold producer that’s been a quiet achiever since bringing its Jaurdi Operation into production in late 2019. Since 2019, BCN has achieved a 28kozpa production profile combined with steady positive operating cash flows. From the generated cash build, BCN has paid out a total of ~A$41.6 million in dividends and reinvested it into project acquisitions that will extend the Jaurdi mine life out to at least FY31. With a 7-year mine life in place, we look for a production profile increase as BCN brings on higher grade ore sources into its mine plan. Argonaut initiates coverage with a Speculative Buy recommendation and a $0.035 price target.

Key points

Track record of operational performance: BCN’s Jaurdi commissioning commenced in late 2019 with the ramp phase occurring during the worst part of the COVID lockdowns. Despite this hurdle, in the four years of production at Jaurdi BCN generated over A$99m of operating cash flows with only two quarters of negative operating cashflow. 7-year mine life in place: After dividends, BCN has invested the balance of its cash build into five strategic project acquisitions for a total cost of around A$31.3M. Once the Lady Ida Acquisition B is finalised, BCN will have reserve/production multiple of 9.5, ahead of many large-scale producers such as RMS, RRL, SLR and WGX.

Higher Grade Feed Options to lift Ounce Profiles: BCN’s Jaurdi mill has a current operating capacity of around ~800ktpa with a +5year TSF capacity. Utilising the existing Jaurdi Mill, we see BCN bringing forward recently acquired higher grade projects Mt Dimer and Lady Ida as the pathway towards an increased ounce profile.

Infrastructure advantage with a M&A niche: We like the competitive advantage that BCN holds in the Coolgardie/Kalgoorlie region. Competing mills in the area - Northern Star (KCGM), Gold Fields (St Ives) and Evolution (Mungari) all require deposits with scale and high margins to fit their portfolio. Of the assets left over, BCN has next to no competition and has been able to acquire projects at its own pace and without acquisition premiums.

1HFY2025 Results: BCN’s 1HFY2025 results delivered a NPAT of A$11.17M with gold sales totalling 16koz at an average realised price of A$2,969/oz. Total cash and cash equivalents totalled A$14.3M as of December 31. A fully franked dividend of A3.7M was paid out in December 2023.

An objective way to determine the #1 best-value gold miner in the world?

To attempt this, I came up with the idea of putting all 30,000 stocks at UncleStock into a filter. The parameters were to sort on owner Earnings Yield. Owner Earnings is a cash flow concept popularized by Warren Buffett in his 1986 Berkshire Hathaway company letter to shareholders. Owner Earnings = (a) Net Income plus (b) depreciation, depletion, amortization, and other non-cash charges minus (c) average annual maintenance capital expenditures.

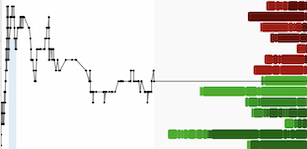

Next, I filtered for only stocks that were gold miners, with less than 4 Allen EV/EBITDA and a debt ratio < 2.0. I then backtested that formula for 16 years, annually refreshing stocks that fit the criteria and only using the 8 best in the OE Yield sort. This filter today only finds 59 stocks, and only about 40 are really gold miners. To my pleasant shock, the CAGR, the average gain per year over 16 years, is 20%! That trounces the SP 500. And both were about the same until 2020, when this filter took off and has beat the SP500 greatly since then.

On the current list of the best gold miners with this filter, indeed, Beacon Mineral shows up as #2. #1 was Majestic, $MJS.v., but it is in China. I have had problems in the past with cooked books there, so I have not bought a stock that has been in China for over 10 years. The above image is the prior-year list, not the current list. So indeed, Beacon ended up being the very best gold miner in the world in a jurisdiction with trustworthy accounting. Eastern Platinum $ELR.v also has superb numbers but is not gold, and it is in South Africa, mine-wise.

I am so glad I made this attempt at creating the objectively best gold miner value finder in the world. Gold miners have underperformed the SP500, but this filter leaves the SP500 in the dust.

The company comes across as very honest and careful with investors money. Here is the most recent video presentation by the Managing Director.

In conclusion, objectively, Beacon Minerals indeed does appear to be the best value among gold miners in the world. I, however, encourage people to comment if they think there is a better one.

2024-04-16 Update: Big news for Beacon, 300 sq km in Timor Leste just acquired https://hotcopper.com.au/threads/ann-highly-prospective-exploration-licences-granted-timor-leste.7953920/

Here is a map of a UN mineral deposits survey and the land Beacon acquired as a first mover Timor-Leste.

Page 38: They concluded that data from historical mineral production and economic reserve amounts from “well-explored” areas (e.g., the United States of America) could be used by the URPV technique to estimate the inventory of mineral resources in “less-explored” or underdeveloped regions. This analysis resulted in a correlation between Timor and Arizona, which had an estimated unit regional production value of US$510,000/sq km. Assuming an area of 16,000 sq km for Timor-Leste, the value of Timor-Leste’s potential mineral production would be US$8,160 million.

Page 39: The most attractive mineral potential of Timor-Leste is in base metals, mainly copper, and associated gold and silver. This potential is in the occurrence of so-called Cyprus-type volcanogenic massive sulfides related to ophiolite sequences. This style of mineralization can be observed in the outcrop in the Ossu area of the Viqueque District. Geological reasoning and extrapolation allow for the conclusion that similar mineralization will be found in other locations where ophiolite sequences are found in the territory. Chromite, vein gold, and certain non-metallic minerals are also found and may have potential. http://www.faultrock.nz/uploads/4/4/8/3/44833089/atlas_of_mineral_resources_of_timor_leste.pdf

Location and geology of the Ossu polymetallic copper prospect including the location of polymetallic boulders relative to mapped serpentinite

Boulder Assays:

Cu % Co % Au g/t Cu % Co %

BRC - 08 9,031,168 875,897 7.59% 0.40% 2.08 4.20% 0.34% Boulder of massive Mt and Cpy.

BRC - 09 9,031,172 875,645 5.89% 0.43% 1.84 5.70% 0.43% Boulder comprised of massive Mt and Cpy.

BRC - 10 9,031,102 875,447 6.73% 0.12% 1.20 7.80% 0.27% Boulder of massive Mt and Cpy with Ma, Lm. Weathered.

BCN021A 9,031,096 875,471 12.00% 0.88% 1.75 12.70% 0.68% Boulder of massive Mt and Cpy.

BCN021B 9,031,107 875,484 0.53% 0.07% 1.69 0.75% 0.11% Boulder of massive Mt with minor Cpy.

BCN025 9,031,108 875,566 1.33% 0.05% 0.36 1.61% 0.04% Boulder of brecciated serpentinite with minor Ma.

BCN026 9,031,091 875,595 0.05% 0.03% 1.43 0.04% 0.03% Boulder of massive Mt with no visible copper minerals.

Averages (all samples) 4.87% 0.28% 1.48 4.69% 0

The Viqueque District Ossu area that the UN report above identifies as promising for Cyprus-type volcanogenic massive sulfides related to ophiolite sequences is the lower block Beacon has, called the Ossu Concessions. So it looks superb in terms of the land package they have obtained.