Gold sector sentiment has taken a sharp turn for the worse in the last few months. It has become increasingly difficult for gold juniors to generate any upside traction in their share prices. Even companies that have delivered stellar drill results have experienced little market enthusiasm.

In one sense, this is a frustrating situation for junior mining investors. On the other hand, the weak sector sentiment and poor price action is offering up plenty of opportunities to buy the best companies at attractive price levels. Well known resource investor Rick Rule recently said, “buy the best because the best are falling in price like the rest.”

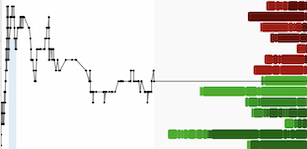

An example of one of “the best” that have been falling in price like the rest is Aton Resources (TSX-V:AAN, OTC:ANLBF). Since the beginning of May, Aton has delivered several news releases chock full of stunning drill results.. After an initial surge on the first set of impressive results, Aton shares have cooled off quite a bit falling to a recent low of $.35 after reaching a high of $.69 on May 10th:

AAN.V (Daily)

Aton shares continue to consolidate in a range between roughly $.40 and $.55, above a rising 50-day simple moving average. Aton’s technical chart structure is excellent, however, its high-grade gold drill intercepts are even better. Aton is focused on a large mining concession (477 square kilometers) in Egypt that flanks the Red Sea. Aton’s Abu Marawat mining concession has a storied history that includes what could be the legendary lost “Mountain of Gold.” The Arabian-Nubian Shield is one of the hottest regions for gold exploration in the world today. And Aton’s results at Abu Marawat help to show why this vastly underexplored geological trend spanning North Africa and the Middle East has received a great deal of interest in recent years.

Abu Marawat is located in an area of Egypt with excellent infrastructure, which is ideal for mining:

- Hamama camp is located 32 kilometers south of the four-lane Qena-Safaga Highway

- Abu Marawat camp is located 25 kilometers south of the four-lane Qena-Safaga Highway

- Power line (220kV), railway line and water pipeline parallels highway

- The port of Safaga 70 kilometers to the northeast

- Hurghada International Airport 120 kilometers to northeast of the Abu Marawat camp and 190 kilometers to the northeast of the Hamama camp

- Luxor International Airport 160 kilometers to the southwest of the Hamama camp

- Aquifers have yet to be quantified, water is currently trucked in from the Nile, 70 kilometers to the west. Process water is slated to be sourced from the Nubian Sandstone aquifer, about 20km to the west of Hamama

- Modern 40 person exploration camps at Hamama and Rodruin

- No permanent settlements in concession area

Egypt has one of the longest histories of gold mining of any country on the planet. The Pharaohs built powerful kingdoms made possible by the unparalleled riches of the Egyptian gold deposits. British-controlled mines were producing gold in Egypt through the early 20th century before the industry went dormant after WW2. Egypt has seen little in the way of gold mining in the last 100 years, with only one producing gold mine currently, at Centamin’s world class Sukari deposit. But based on the tremendous exploration success of Aton Resources, that could change very soon. Since the beginning of May, Aton has delivered some of the best results in the entire junior mining sector.

June 13th, 2022: Aton drills further wide zones of oxide mineralisation at Rodruin, returning 1.72 g/t gold and 11.5 g/t silver over 75.2m from surface

All of the above news releases are drill results from Aton’s Rodruin Project. In 2017, the Aton team made the first new gold discovery in Egypt in more than 100 years called the Rodruin Project. Based upon large, deep ancient underground mine works, Aton believes that Rodruin could be the location of the lost “Mountain of Gold'' that local Bedouin tribes have long rumored to have existed.

A first-pass RC drill program was completed in December 2018, consisting of 50 holes, for a total of 4,125 meters. Gold mineralization and/or ancient workings were intersected in virtually every drill hole, including a mineralized intercept of 56 meters grading 8.20 g/t gold, from surface, in hole ROP-003 at the Aladdin’s Hill area.

It’s difficult to overstate just how good the results were from the phase 1 program at Rodruin. To drill a 450+ gram-meter hole in the third hole into a new target is completely unheard of. Aton began a phase 2 drilling campaign at Rodruin in November 2021 and results of this drilling have been even more impressive.

Drilling at Rodruin has demonstrated extensive zones of consistent, near-surface gold mineralization. These wide zones of consistent mineralization that outcrop at surface are expected to be amenable to non-selective open pit mining techniques, with very low stripping ratios. In addition, Rodruin features a unique combination of extensive near surface oxide gold mineralization, as well as deeper polymetallic sulfide mineralization that begins at approximately 100 meters depth.

The South Ridge Thrust truncates the oxide mineralization at depth at least at the “Central Buttress Zone”. Two recent drill intersections from Aladdin’s Hill returned 1.72 g/t gold and 11.5 g/t silver over 75.2 meters (hole ROD-079), and 1.28 g/t gold and 6.9 g/t silver over 46.2 meters (hole ROD-078). These two holes indicate the presence of a block of consistently mineralised rock, approximately 45-50 meters thick extending all the way to the surface in this area.

Aladdin's Hill at Aton's Rodruin Project in Egypt

Below the South Ridge Thrust, an extensive zone of higher-grade polymetallic sulfide mineralization is present. In total, Aton has 12 holes still pending assays and these include several holes that were drilled to test the deeper sulfide mineralization. Aton is currently focusing on drilling out the oxide mineralization in the CBZ (Central Buttress Zone) with the aim of producing a maiden resource estimate late this year or in early 2023. However, Aton will certainly be going back to drilling the sulfide mineralization soon.

It is still early days at Rodruin, however, drilling to date has proven extensive gold mineralization along 500 meters of strike extent, 200 meters width, and to depths of nearly 300 meters. Considering the extremely high grades intercepted in numerous holes across multiple zones at Rodruin, a 1,000,000+ ounce maiden resource is not terribly far-fetched.

While Rodruin is clearly Aton’s focus currently, the company’s Hamama Deposit hosts an NI43-101 compliant resource that shows an Inferred Mineral Resource of 341,000 ounces’ gold equivalent (AuEq) and an Indicated Mineral Resource of 137,000 ounces AuEq.

Three mineralized zones have been identified to date at Hamama - Hamama West, Hamama Central, and Hamama East, and high grade gold mineralised quartz veins have also been discovered at West Garida, 3 kilometers to the east of Hamama West. In addition, ancient iron and copper mining and smelting sites have been identified in the general Hamama area. There is also evidence of ancient gold mining sites and tailings dumps in the North Garida area approximately 4 kilometers northeast of Hamama West.

From my estimation Aton is undervalued based solely on the results to date at the Rodruin Project, at today’s share price investors get the half million ounces at Hamama for free. The Ministry of Petroleum and EMRA (Egyptian Mineral Resources Authority) continue to advance the mining and exploration sector in Egypt. Just two weeks ago the EMRA awarded eight new areas for gold exploration in the Eastern Desert of Egypt. Aton is at the vanguard of the modernization of the mining sector in Egypt and the company stands to benefit from the Egyptian government’s continued focus on stimulating investment in the country’s natural resources. Aton’s goal is to develop multiples mines on the Abu Marawat Concession.

I have accumulated a position in Aton shares in recent weeks and I intend to add to this position in the future if further drilling at Rodruin proves my theory that this project hosts more than 1,000,000 ounces of highly economic gold (potentially much more than 1,000,000 ounces).

Disclosure: Author owns shares of Aton Resources at the time of publishing and may choose to buy or sell at any time without notice. Author has been compensated for marketing services by Aton Resources Inc.

DISCLAIMER: The work included in this article is based on current events, technical charts, company news releases, and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. This publication is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.